Plend

A lending platform with a unique credit scoring system.

- Service

- Custom Software Development

- Industry

- FinTech

Customer goal

Many people face challenges accessing bank loans due to their credit history. A flawed credit scoring system can lead to inequitable decisions being made, based on inaccurate data. If you are deemed as ‘prime’ you’ll have no trouble accessing a significant bank loan at a rate in the single figures. However, if you fall short of the strict criteria, you’ll be forced to take a short-term, high-cost loan in the most common credit scoring systems.

Our customer, Plend, had an idea to build a fintech product that provides a personalized, informed, and fairer credit decision-making process. Using the PLEND Score® to assess affordability rather than solely relying on the credit score, Plend is able to offer affordable, longer term loans to customers across the UK. This technology helps them on their mission to create a financially inclusive world where everyone has the chance for a brighter future.

Plend is also able to offer their product to third parties, including personal-lending CDFIs (Community Development Finance Institutions, community lenders) at no cost.

Solution

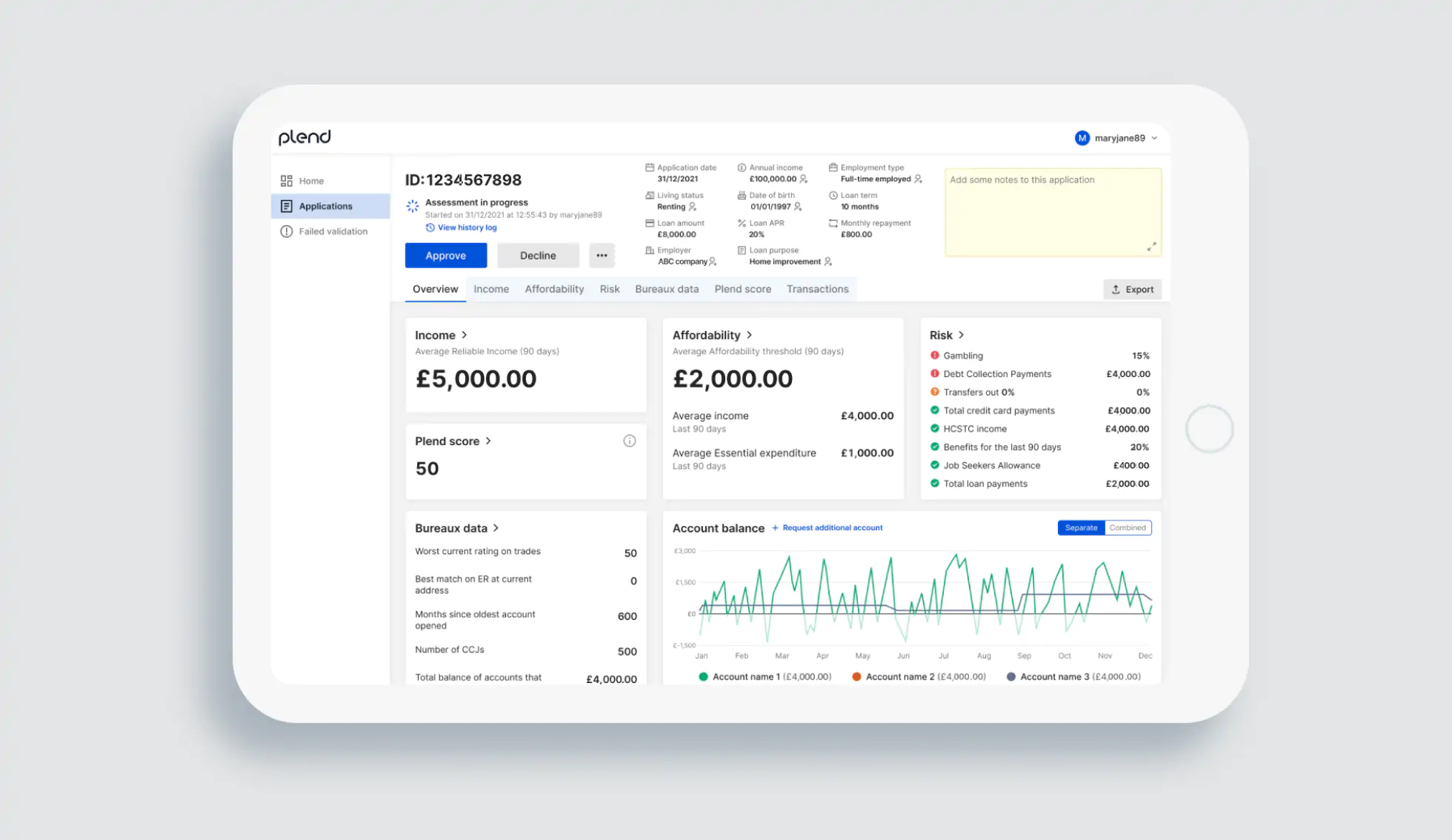

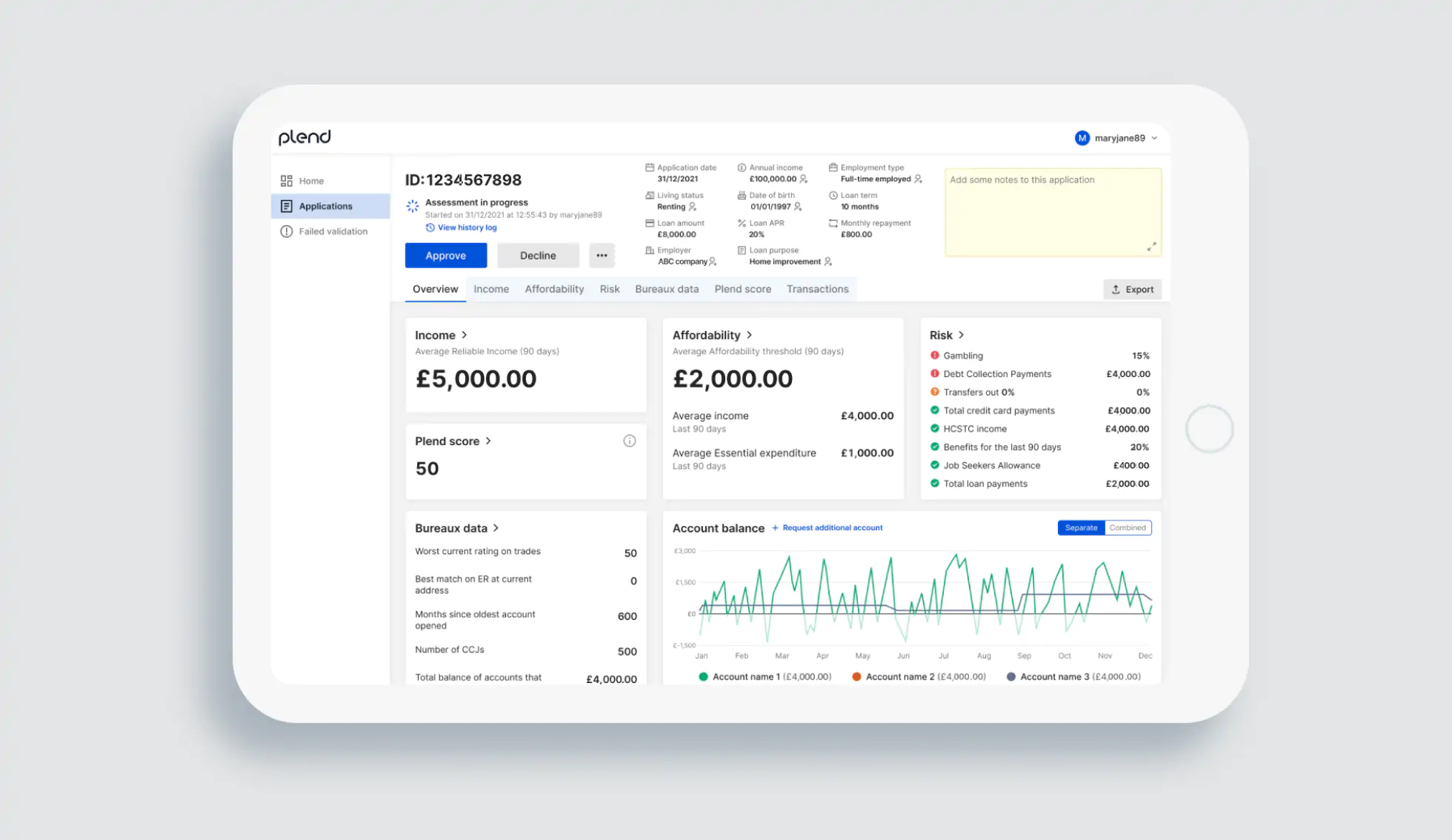

Our team worked with Plend to develop a fintech solution for making fairer credit deals with a better understanding of a borrower’s financial situation. The new credit analysis system includes scoring, configuration, and authentication modules, all available in a visual dashboard.

We met Plend in the autumn of 2021, after they reached out to us with a software idea, defined business logic, and scoring rules. Starting with the discovery phase, we identified and discussed project requirements, evaluated and planned project activities, and designed the app’s architecture.

From the beginning, we wanted to ensure the task could be executed successfully, so we prepared a prototype of the customer’s idea. Secondly, in order to obtain a complete picture of borrowers’ financial situations, we integrated with a third-party system to classify the data and better understand them.

As a result, we developed the authentication module for creating or removing users as well as the configuration and scoring modules designed to evaluate loan applications using carefully calculated criteria: we looked specifically at items such as a borrower’s income and spending, as well as various categories such as age, and other data.

Our configuration module includes 3 stages within the validation process with set rules for managing loan applications. The scoring module receives the financial information about borrowers from third-party services, and exchanges this data with the configuration module and its rules. At the end of the process, the lender is provided with the necessary information for deciding the result of a loan application.

While developing the scoring module, we needed to implement the classification of users’ transactions to provide a quick evaluation of borrowers’ financials. At first, this process took a lot of time, and there were problems with the production of the module. The application processing time depends on transaction numbers, which was slowing down the scoring time. However, after some improvements, we achieved a promising result — 1 application completely processed in only 2 minutes.

Exposit you can trust not just to build complex, original work, but also support the developed product and ensure it thrives after release.

James Pursaill

CTO at Plend

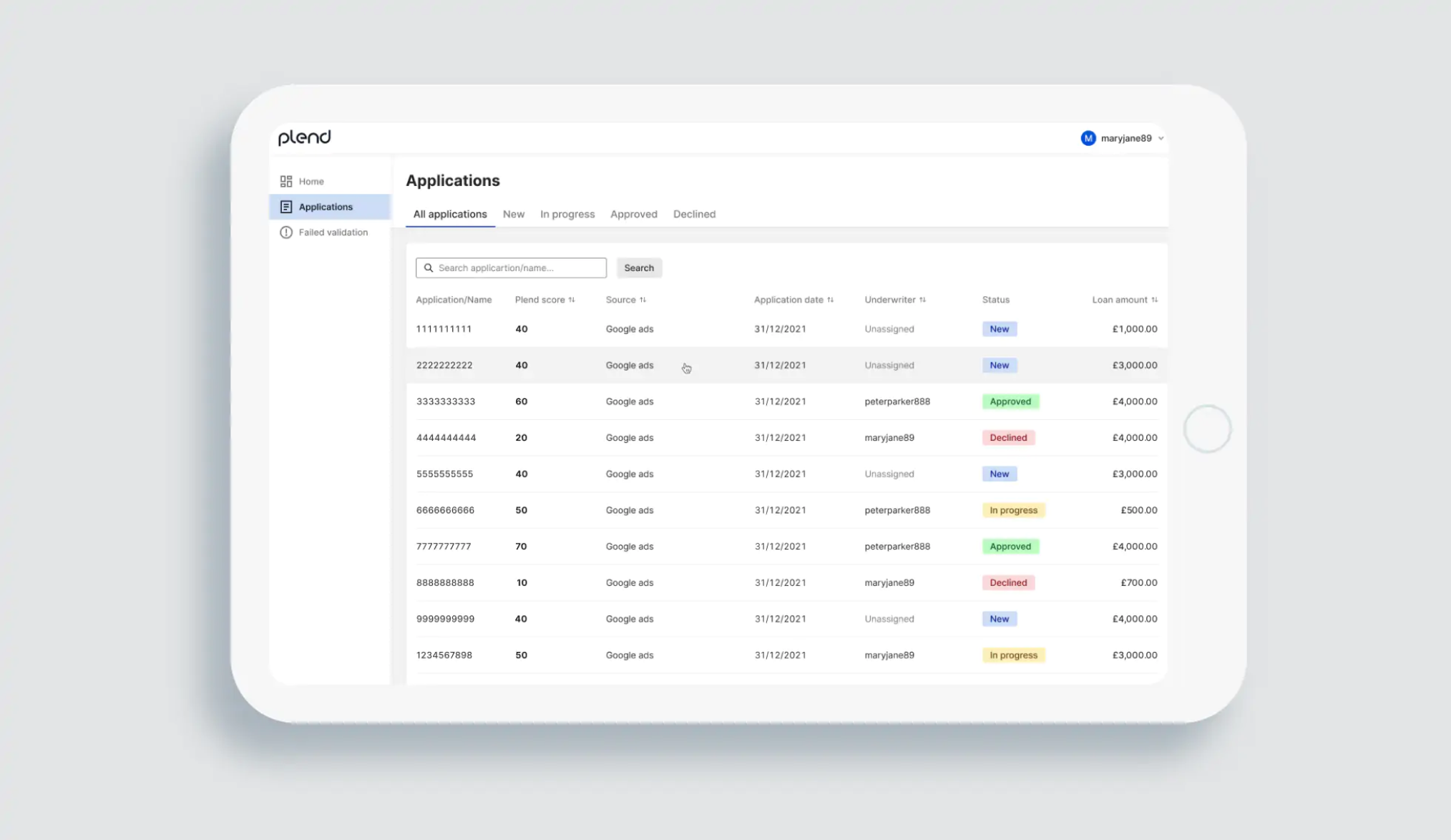

We also implemented visual dashboards to provide convenient data view and analysis, as well as an administration panel which helps to effectively manage loan applications and credit deals.

Our client wanted a simple and rigorous solution because the main challenge here was the abundance of statistical information, so we created the design of this new credit score system from scratch, making it truly unique to Plend. The design helps users to easily find the necessary information and efficiently look at a a complete picture of the application.

In addition, the system could be used as a white label, allowing for customer partners to add their own branding. Thanks to this new detailed automated scoring system, based on an accurate analysis of relevant and up-to-date information, Plend is able to avoid bad deals, and personalize credit to make smarter lending decisions, creating an environment where people are not held back by their credit history.

The fully featured fintech software implemented from the ground up, from the idea to launch and maintenance.

A viable product that allowed Plend to close in on its first million pounds of lending volume in one month from launch.

An engine with a seamless digital borrower assessment using a wealth of rich OB data to write safer loans than the competition.